Weekly News Roundup – 7 Jun 2021

Crypto moves fast and it can be hard to keep up with all the developments. To help you stay on top of what’s going on across the industry, we’ve created this overview of the key news from last week.

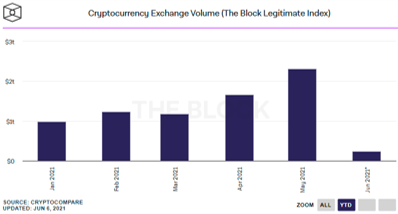

- Crypto exchanges have seen more than $2 trillion in volume this month, according to The Block's Data Dashboard, setting a new record.

- Crypto exchanges have seen more than $2 trillion in volume this month, according to The Block's Data Dashboard, setting a new record.

Crypto exchange volume crosses $2 trillion in May — the highest ever in history

- Crypto exchanges have seen more than $2 trillion in volume this month, according to The Block's Data Dashboard, setting a new record.

- May is the fourth month in a row where such exchanges have seen more than $1 trillion in volume, according to The Block's legitimate volume index.

https://www.theblockcrypto.com/linked/106654/crypto-exchange-volume-2-trillion-may-highest-history

31.05.2021

El Salvador's president announces legislative proposal to declare bitcoin legal tender

- Nayib Bukele, El Salvador's president, announced Saturday that he plans to submit a legislative approval which would grant bitcoin the status of legal tender in his home country, meaning that courts of law would be required to recognize it as satisfactory payment for any monetary debt.

- "We hope that this decision will be just the beginning in providing a space where some of the leading innovators can reimagine the future of finance, potentially helping billions around the world," Bukele said in a Twitter post on Saturday evening.

- “Holding bitcoin provides a way to protect developing economies from potential shocks of fiat currency inflation," said Jack Mallers, founder and CEO of bitcoin startup Strike which is working on the initiative with the El Salvadorean government.

https://www.theblockcrypto.com/linked/107381/el-salvador-bitcoin-legal-tender

06.06.2021

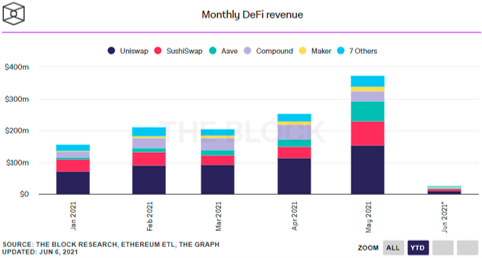

DeFi protocols generated more than $370 million in revenue during May

- Decentralized finance (DeFi) protocols built on Ethereum produced all-time high revenues in May.

- Taking the top spot for the month was Uniswap, reaching $153.9 million (41.4%) of the $371.6 million total monthly DeFi protocol revenue. Sushiswap had the next largest portion at 20.3%, followed by Aave at 16.6%.

- As expected, much of the revenue went to the supply-providers—that is, those providing liquidity to the protocols.

https://www.theblockcrypto.com/linked/106858/defi-protocols-ethereum-may-revenue

01.06.2021

ETC Group to list First Bitcoin ETP in London on the Aquis Exchange

- ETC Group is launching the first bitcoin exchange-traded product (ETP) in the UK on the Aquis Exchange Multilateral Trading Facility (MTF) in London on 7 June.

- This is the first time a cryptocurrency ETP will be made available for trading on the UK market or any European MTF.

- Trading of the ETP will take place in four different currencies—GBP, CHF, euro, and U.S. dollar. The clearing will be carried out by Switzerland-based central counterparty clearing house SIX x-clear.

- The firm said it has seen investors include exposure to crypto ETPs in their portfolios as a hedge against inflation.

https://www.coindesk.com/etc-group-to-list-first-bitcoin-etp-in-london-on-the-aquis-exchange

01.06.2021

More than 5 million ETH has been sent to Ethereum 2.0's deposit contract

- The amount of Ether (ETH) in the Ethereum 2.0 staking contract has broken above the 5 million mark. The current amount in the contract is 5.2 million ETH, worth $14.5 billion. One ETH is currently priced at $2,782.

- The Ethereum blockchain is undergoing a shift from a proof-of-work consensus mechanism to a proof-of-stake one, as part of the main Ethereum 2.0 upgrade. This will move the blockchain away from being reliant on miners to process transactions, allowing anyone who is willing to stake 32 ETH to process them instead — at the risk of losing their coins if they act maliciously.

- There are currently 152,000 validators (as opposed to miners) processing blocks on the proof-of-stake network.

- Both the deposits and the rewards can only be withdrawn once phase 1.5 of the Ethereum 2.0 upgrade goes live, which is scheduled for 2022.

31.05.2021