Bitstamp Monthly Briefing – March 2025

March was a mix of ups and downs. The total crypto market cap dropped, but Bitcoin gained strength. At the same time, tokenized assets started gaining momentum, with more institutions getting involved. Here’s a quick look at what happened and what’s coming next.

H3: Market update

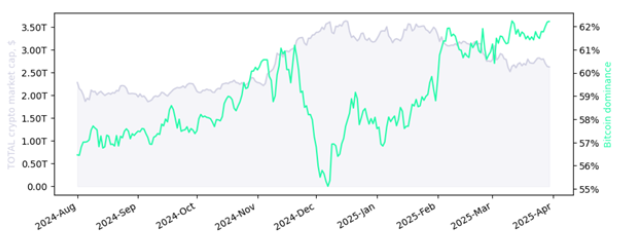

The total crypto market cap decreased by 4.3% month-over-month, ending March at $2.63 trillion. Trading volume on the leading crypto spot exchanges we monitor declined by 14% during this period.

Bitcoin’s market dominance increased by 1.41 percentage points month-over-month, reaching 62.3%.

Total crypto market cap (grey) and BTC dominance (green)

Past performance is not a reliable indicator of future results. The performance of crypto assets can be highly volatile. Data taken on April 1, 2025.

H3: Biggest movers in March

- +34.6% Cronos (CRO) - The token saw a significant price surge following key news, including the closure of an SEC investigation.

- +23.5% Toncoin (TON) - Price gains were driven by multiple catalysts, including TON’s integration with the Telegram app and Grok AI integration into the TON ecosystem.

- +12.0% Bitget Token (BGB) - BGB found strong support at the $4 level, bouncing higher from that base.

- -66.5% Pi (PI) – PI's price faced significant challenges due to increased token supply from unlocks and overall market volatility.

- -44.1% Jupiter (JUP) – A lack of positive catalysts, technical breakdowns, and broader market trends contributed to its sharp decline.

- -41.7% JasmyCoin (JASMY) – The price failed to hold support at the $0.013 level, resulting in a price drop.

Past performance is not a reliable indicator of future results. The performance of crypto assets can be highly volatile. Data taken on April 1, 2025.

Key macro & crypto events in April 2025

- April 6-9: Hong Kong Web3 Festival in Hong Kong

- April 8-10: Paris Blockchain Week in Paris, France

- April 9: FOMC minutes

- April 10: US Inflation & Core Inflation Rate

- April 14: ETH Seoul in Seoul, South Korea

- April 15: Strategic Bitcoin Reserve Summit in Washington, DC, USA

- April 17: Governing and General Council of the ECB in Frankfurt, Germany

- April 28-29: Unchained Summit 2025 in Dubai, UAE

- April 28-29: ETHDubai 2025 in Dubai, UAE

- April 30-May 1: TOKEN2049 Dubai in Dubai, UAE

The rise of tokenized assets: transforming global finance

In recent years, the financial landscape has witnessed a profound shift with the emergence of tokenized assets. This innovative approach involves converting traditional assets, such as bonds, equities, real estate, and commodities, into digital tokens on blockchain platforms. Tokenization is not only enhancing liquidity and accessibility but also reshaping how major institutions and governments approach financial markets. In this deep dive, we explore the benefits of tokenized assets, their adoption by major institutions, the impact on traditional finance (TradFi) and decentralized finance (DeFi), and the regulatory challenges that come with this transformation.

Tokenization offers several key benefits that are revolutionizing financial markets, such as liquidity, accessibility, and efficiency.

Tokenization significantly enhances liquidity by allowing for fractional ownership and enabling assets to be traded 24/7 on blockchain platforms. This means that investors can buy and sell fractions of high-value assets like real estate or art, which were previously inaccessible due to their high cost. For instance, tokenized real estate allows multiple investors to own a portion of a property, making it easier to enter the market and exit when needed. Additionally, tokenization reduces transaction costs and settlement times, making it more efficient than traditional methods.

By democratizing investments, tokenization lowers barriers for individuals who were previously excluded due to high costs or geographical constraints. Anyone with an internet connection can now invest in tokenized assets, opening up new opportunities for global participation. This democratization is particularly significant in emerging markets where access to traditional financial instruments may be limited.

Tokenization also brings operational efficiencies through blockchain automation. Transactions are faster, with settlement times reduced from days to minutes. Moreover, blockchain's immutable records provide transparency and reduce the risk of fraud, making it a more secure way to conduct financial transactions.

Major financial institutions and governments are increasingly adopting tokenization to streamline financial operations. Leading institutions such as BlackRock, JPMorgan, and Barclays are integrating blockchain technologies, with JPMorgan’s stablecoin, JPM Coin, facilitating cross-border payments and collateral settlements. Central banks are also exploring tokenized assets through initiatives like the New York Fed’s tokenized deposits and Singapore's Project Guardian. Tokenization is applied to areas like money market funds, real estate, and venture capital, eliminating intermediaries and reducing transaction costs.

Despite the potential benefits of tokenized assets, regulatory challenges remain a significant barrier. A key issue is the lack of standardized global regulations, as different jurisdictions have varying frameworks. This creates legal uncertainty for institutions considering tokenization, with countries like the U.S. and Europe taking divergent approaches to regulating digital assets, potentially slowing adoption.

Additionally, tokenization has geopolitical implications as nations compete for leadership in blockchain-based financial innovation. There are concerns about the risks of programmability and the need to balance automation with security. The early adoption of tokenized assets may also shift economic power dynamics, giving a competitive advantage to countries that embrace these technologies first.

In conclusion, the rise of tokenized assets is transforming global finance by enhancing liquidity, accessibility, and efficiency. As major institutions and governments continue to adopt these technologies, it is crucial for regulators to address the legal uncertainties and geopolitical implications. Collaboration among institutions, regulators, and technology providers is essential to unlock the full potential of tokenized assets and ensure a stable transition into this new financial landscape.

Recommended reads

Is Bitcoin Still Following the 2017 Bull Cycle

Bitcoin’s recent multi-week downtrend has diverged from its historically strong correlation with the 2017 bull cycle, though the overall similarity remains high. Key indicators like the MVRV Ratio suggest the market is still following past patterns despite short-term deviations. A potential explanation for this divergence is data lag, as Bitcoin’s price often reacts to liquidity changes with a delay. When adjusted for this lag, the correlation with 2017 rises to 93%, implying that Bitcoin could soon resume its historical trajectory, potentially leading to a strong recovery and another rally.

The Crosscurrents Shaping Crypto Markets

by Coin Metrics

Crypto markets have faced renewed volatility due to macroeconomic pressures and industry challenges despite positive developments like regulatory progress and institutional adoption. Bitcoin remains largely uncorrelated to traditional assets, with its dominance rising as institutional capital grows while retail activity remains muted. Altcoins, especially Ethereum, have underperformed, and the leverage has reset, creating a healthier market structure. Bitcoin’s MVRV ratio suggests a mid-cycle reset, with historical trends indicating potential future growth. While uncertainty persists, improving macro conditions, regulatory clarity, and structural shifts like ETFs and institutional interest could drive the next phase of the crypto market’s expansion.

Inside The Minds of Institutional Investors

by The Wolf Den

A recent Coinbase and EY-Parthenon survey of 352 institutional investors reveals that institutional interest in crypto is growing, with 85% increasing allocations in 2024 and a similar trend expected in 2025. Regulatory clarity remains the top catalyst for further adoption, and institutions prefer gaining exposure through registered vehicles like ETPs. Hedge funds lead in altcoin and stablecoin usage, while DeFi engagement is projected to triple in two years. Tokenization is also gaining traction, with 61% of firms planning investments. Despite market volatility, institutional capital is steadily flowing into crypto, signaling long-term growth and broader adoption.

The Parallel Economy Mirage

by Kyla Scanlon

The global impact of U.S. economic volatility, bot-driven misinformation, and ideological market fragmentation is reshaping international trade, investment, and financial stability. As unpredictable policies and tariff shifts disrupt supply chains, nations seek alternative trade alliances, accelerating the decline of globalization and the rise of economic nationalism. The manipulation of financial narratives weakens trust in institutions worldwide, while ideological economies create further market segmentation. This fragmentation fuels uncertainty, discourages investment, and risks undermining the stability of the global financial system, potentially shifting economic power away from the U.S. and toward emerging multipolar alliances.

No information in this blog is intended to provide any personal investment services or advice nor is it an investment recommendation. Clients are responsible for making their own investment decisions. Bitstamp accepts no responsibility for any damage and/or loss arising from the use of information provided herein. Past performance is not necessarily an indicator of future results. Please consider your individual position and financial goals before making an independent investment decision.

Bitstamp is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Licensed as a Money Transmitter by the New York State Department of Financial Services.

Not offered in the following states: Hawaii and Nevada

This blog post has been approved as a financial promotion by Bitstamp UK Limited which is registered with the UK’s Financial Conduct Authority. Please read the Risk Warning Statement before investing. Cryptoassets and cryptoasset services are not regulated by the Financial Conduct Authority. You are unlikely to be protected if something goes wrong. Your investment may go down as well as up. You may be liable to pay Capital Gains Tax on any profits you earn.