Bitstamp Monthly Briefing – March 2024

Diving into the latest crypto action with Bitstamp’s latest Monthly Briefing! Again, we’re zeroing in on the hottest topics in crypto, providing insights into the evolving market. Central to our discussion is the eagerly awaited Ethereum ETF, alongside a series of influential trends currently shaping the crypto world. We want to bring you up to speed and prepare you for the changes ahead.

Shall we dive in?

Market update

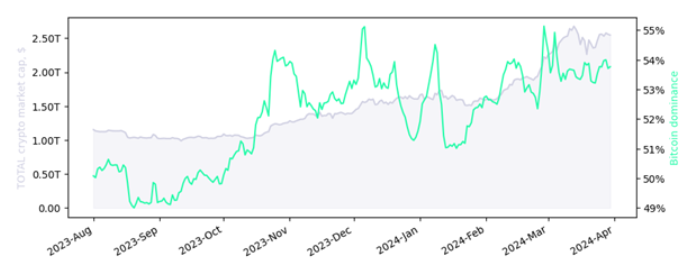

The total crypto market cap saw a 19.0% increase month-over-month, reaching $2.62 trillion at the end of March. Trading volume on the leading crypto spot exchanges we monitor saw a 113% increase during this period.

BTC's market dominance dropped by 1.0 percentage point month-over-month to 53.6%.

Total crypto market cap (grey) and BTC dominance (green)

Past performance is not a reliable indicator of future results. The performance of crypto assets can be highly volatile. Data taken on April 1, 2024.

Source: Total crypto market cap, Bitcoin dominance

Top performing CMC 100 assets in March 2024

- + 449.2% dogwifhat (WIF) - This popular meme coin on Solana attracted a large buying interest

- + 296.9% Core (CORE) - The rally is mainly attributed to several upgrades to the Core network

- + 219.4% FLOKI (FLOKI) - FLOKI announced a strategic partnership with Carbon Browser

Worst performing CMC 100 assets in March 2024

- - 18.5% Kaspa (KAS) - The price failed to breach the $0.15 resistance level

- - 15.5% Bittensor (TAO) - The price formed a double top pattern around $750

- - 14.6% Arbitrum (ARB) - the price declined days after a large ARB token unlock

Past performance is not a reliable indicator of future results. The performance of crypto assets can be highly volatile. Data taken on April 1, 2024.

Key macro & crypto events in April 2024

- April 9: Frankfurt Tokenization Summit

- April 9-11: Paris Blockchain Week

- April 10: US Core Inflation Rate

- April 10: FOMC Minutes

- April 11: ECB Monetary policy meeting

- April 15-16: Blockchain Life 2024 in Dubai

- April 15-18: Web Summit Rio

- April 22-23: World Blockchain Summit Dubai

- April 22-28: Southeast Asia Blockchain Week 2024 in Thailand

- April 23-25: Money20/20 Asia

- April 25-26: ECB’s Inaugural conference on the challenges for Monetary Policy Transmission

Awaiting the Ethereum Exchange-Traded Fund decision

Following the recent US approval of spot Bitcoin Exchange-Traded Funds (ETFs), attention and anticipation have now shifted to the possibility of a spot Ethereum ETFs (ETH ETF) being approved for trading next. Like other ETFs, the ETH ETF is a financial product designed to track the price of an underlying asset, in this case, Ethereum, enabling investors to participate in the cryptocurrency market without directly managing digital assets. The deadline set by the Securities and Exchange Commission (SEC) for approving spot ETH ETF applications is May 23.

Several industry giants, including VanEck, Fidelity, Hashdex, and ARK 21Shares, are eagerly awaiting the SEC's decision. Each has applied to a spot ETH ETF, targeting the rising investor interest in Ethereum. However, the SEC's postponement of Ether ETF decisions from firms like Fidelity, BlackRock, and Grayscale has introduced uncertainty regarding the future approval of ETH ETFs.

A primary concern raised by the SEC pertains to Ethereum's proof-of-stake (PoS) system and the practice of staking. Staking involves locking up cryptocurrency funds to support the operations of a blockchain network, and it has become a fundamental aspect of Ethereum's ecosystem. The SEC has voiced concerns about investor protection and regulatory oversight when it comes to staking activities and scrutinized staking providers in 2023. Unlike traditional investments where investors directly hold assets, ETFs pool investors' resources to invest in a portfolio comprising the underlying asset. This indicates heightened SEC interest in how custody and control are managed regarding Ethereum ETFs.

Despite these regulatory hurdles, some industry insiders remain optimistic about the prospects of spot ETH ETF approval. They contend that Ethereum's technological advancements, especially its shift to a PoS consensus mechanism, render it a robust and secure investment option. Consensys, a leading blockchain firm known for its widely used MetaMask wallet, even submitted a comment letter to the SEC, arguing for Ethereum's superiority over Bitcoin in terms of block finality, decentralization, and environmental sustainability, owing to its PoS system.

As the SEC's decision deadline approaches, stakeholders are closely watching regulatory developments and potential signals from the SEC. The outcome of this decision will not only impact the immediate prospects of spot ETH ETFs but also shape the broader investment landscape for Ethereum and other cryptocurrencies.

Recommended reads

Maslow’s Apex: Bitcoin’s Liberation of the Human Spirit with the Bitcoin Pup

Maslow's Hierarchy of Needs outlines human motivation, starting with basic needs like food and shelter and progressing to higher-order needs like self-actualization and transcendence. The journey through these needs symbolizes personal growth and fulfillment. The author describes their own experience of feeling trapped in a cycle of work and consumption until they discovered Bitcoin. Bitcoin's decentralized nature and limited supply offer a potential solution to the problems inherent in traditional fiat currencies, providing a pathway towards financial stability and personal growth. This journey mirrors Maslow's concept of self-transcendence, where individuals move beyond their own concerns to contribute to a greater cause, envisioning a world where monetary systems are equitable and sustainable. The author invites readers to explore Bitcoin as a tool for creating a better future, one where personal and societal well-being are intertwined.

Bitcoin Endgames & The New Hyperagents by Dave Nadig

Dave Nadig discusses how Bitcoin, as a psychological commodity, derives its value from what others are willing to pay. He explores two potential futures: one where Bitcoin becomes a wealth reserve for early adopters, shifting power from traditional finance elites to crypto enthusiasts, and another where speculative bubbles cause a wealth transfer from latecomers to early adopters, possibly deepening societal divides. Nadig speculates on the impact of Bitcoin hitting $1 million, ranging from crypto elites influencing global politics to potential corporate oligarchy or regulatory pushback. He questions if lessons from the crypto realm apply to wider societal issues and calls for responsibility among those gaining new influence.

IQ in The Wolf Den #924

Warren Buffett highlights that successful investing relies more on rational thinking than on high IQ, challenging the idea that investment success is tied to intelligence. Despite his high IQ, Buffett often credits his success to rationality and humility. This view suggests that anyone can succeed in investing with the right attitude and approach.

The Only Thing We Have to Fear Is the Fear of Missing Out by Anthony Isola

Investors are warned against overconfidence, stressing the importance of adhering to a plan, staying emotionally balanced, and considering contrary opinions, especially during market volatility. The article uses the story of Charles Joughin, who survived the Titanic, as an example of mistaking luck for skill. Joughin’s unique circumstances allowed him to remain composed, underlining the unpredictable nature of such events.

No information in this blog is intended to provide any personal investment services or advice nor is it an investment recommendation. Clients are responsible for making their own investment decisions. Bitstamp accepts no responsibility for any damage and/or loss arising from the use of information provided herein. Past performance is not necessarily an indicator of future results. Please consider your individual position and financial goals before making an independent investment decision.

Bitstamp is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Licensed as a Money Transmitter by the New York State Department of Financial Services.

Not offered in the following states: Hawaii and Nevada

Bitstamp UK Limited is registered with the UK's Financial Conduct Authority. Please read the Risk Warning Statement before investing. Cryptoassets and cryptoasset services are not regulated by the Financial Conduct Authority. You are unlikely to be protected if something goes wrong. Your investment may go down as well as up. You may be liable to pay Capital Gains Tax on any profits you earn.